Crypto asset prices and institutional interest hit new highs in 2025, but at the cost of a shadow economy that grew alongside them. The Chainalysis 2026 Crypto Crime Report places the cost of scams and fraud at $17 billion for the year. This number points to a structural change in cybercrime.

We have moved past the era of the solitary hacker targeting private keys; today’s threats involve psychological manipulation at an industrial scale. With impersonation scams up 1,400% year-over-year, the tactical shift is obvious. Blockchain infrastructure is becoming robust enough to repel direct attacks, pushing criminals to bypass the technology and target the user directly.

AI Is on the Rise Among Cybercriminals

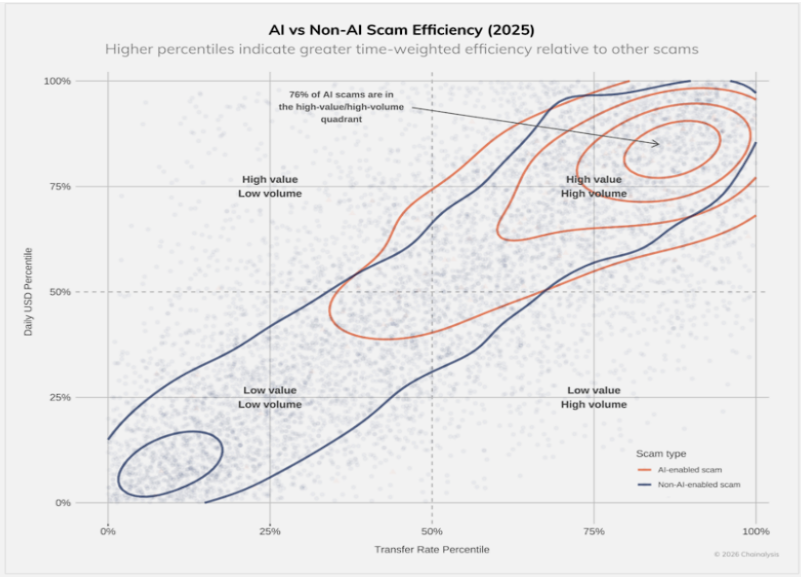

We are witnessing a shift from random theft to professionalized, factory-scale fraud. Syndicates now use machine learning to expand their reach, operating with corporate-level efficiency. TRM Labs reports a 456% jump in AI-enabled fraud and scams over the last year. This surge indicates that technology has removed the technical ceiling for attackers. It allowed them to launch sophisticated campaigns with minimal effort.

The economic incentive for this technological pivot is clear. Chainalysis data reveals that AI-enabled scams are now 4.5 times more profitable than traditional methods, generating an average of $3.2 million per operation compared to just $719,000 for standard schemes.

This profitability drives the pervasive “Crime-as-a-Service” model. Modular phishing kits, such as the “Lighthouse” kit, allow relatively unsophisticated actors to launch complex attacks that mimic legitimate platforms with terrifying accuracy. These kits are often supported by a supply chain of developer groups, data brokers, and spammers, democratizing access to high-level cybercrime tools.

However, the most disturbing evolution involves the integration of generative AI into pig butchering romance scams, often tied to Southeast Asian crime syndicates. Here, attackers deploy deepfake videos to mimic executives and use voice cloning to trick family members or beat biometric checks.

The operational patterns confirm these are not isolated incidents. Forensic analysis reveals a clear holiday effect, where on-chain crime volumes drop during regional holidays. These syndicates run like businesses, and their operators take days off. We are witnessing the weaponization of trust where digital tools are used to dismantle human skepticism.

Using AI Against AI to Protect Users

Combatting an adversary that never sleeps and scales infinitely requires a defense mechanism built on the same advanced technologies. For major infrastructure providers, security has evolved into a proactive discipline defined by trust-by-design.

Securing 300 million registered users, a milestone Binance recently achieved, requires moving past manual oversight. The platform serves as a case study for trust by design at scale. To manage the volume, the exchange deploys intelligent, automated defense systems that track and analyze transaction patterns in real-time.

The results of this architectural shift are measurable. According to the exchange’s 2025 Year in Review, internal risk measures prevented $6.69 billion in potential fraud and scam losses for 5.4 million users throughout the year. These defensive systems leverage over 100 AI models powering anti-fraud controls, detecting anomalies such as rapid inflows consistent with wallet drainers or smart enhanced due diligence that adapts to risk levels dynamically.

Binance Chief Compliance Officer Noah Perlman noted that the “analysis of independent industry data shows a steep reduction in our direct illicit exposure between early 2023 and mid-2025, even as Binance handled growing volumes comparable to the next six largest exchanges combined.”

The drop in exposure indicates that major platforms are getting better at deflecting illicit funds, even as global crime volumes rise. This defense is structured, not experimental. Binance, for example, secured the ISO 42001 certification last December. This ensures that the over 24 AI initiatives deployed across compliance and user screening operate within strict, internationally recognized guardrails.

The company’s defense strategy also extends beyond the digital perimeter through active collaboration with law enforcement, having processed over 71,000 requests in 2025 to aid investigations. Richard Teng, Co-CEO of Binance, emphasized that “scale and trust need not be in tension”: the more people trust the system, the more it grows and the more growth rewards serious compliance and security efforts.

By reducing direct exposure to major illicit funds categories by 96% between 2023 and 2025, the industry is demonstrating that security is the ultimate utility for mass adoption.

The Architecture of Digital Trust

The convergence of cybercrime and compliance defines the current era of the digital asset market. As artificial intelligence lowers the technical barrier for criminals, it simultaneously raises the ceiling for defenders, creating a perpetual adversarial environment.

The future of crypto adoption won’t be determined solely by price action or token utility, but by the capacity of infrastructure providers to guarantee safety amidst this volatility. Platforms that successfully combine deep liquidity with rigorous trust by design principles will ultimately define the next phase of the digital economy, proving that a secure financial system can be built for the AI era.

(Image by WorldSpectrum from Pixabay)